APA Certified Payroll Professional (CPP) Practice Tests & Test Prep by Exam Edge - Study Tips

** Sample images, content may not apply to your exam **

Feeling overwhelmed about preparing for the APA Certified Payroll Professional exam? A customized study plan will help you stay organized as you break down test prep into manageable steps. Get started with our tips on how to:

- Identify your learning style

- Find the APA Certified Payroll Professional exam requirements

- Stay organized

- Create a study plan for the APA Certified Payroll Professional

- Practice test-taking strategies

Not ready to purchase our complete practice tests yet? Start with a APA Certified Payroll Professional FREE Practice Test first!

Tips and Test Prep for passing the APA Certified Payroll Professional (CPP)

We've compiled a list of study tips to help you tackle your test preparation and ace your APA Certified Payroll Professional exam. Whether you are just starting your journey with studying or need a bit of inspiration to refresh your routine, these tips are designed to give you the edge you need to pass your exam with flying colors.

Create a APA Certified Payroll Professional Study Plan

- Review exam requirements: Check the American Payroll Association 's requirements for the APA Certified Payroll Professional exam to make sure your studying approach suits the exam's format and content.

- Identify your learning style: Everyone learns differently, and most of us learn best when we get the same information in a variety of delivery methods. Identify the learning styles and studying approaches that best work for you to maximize your study efforts.

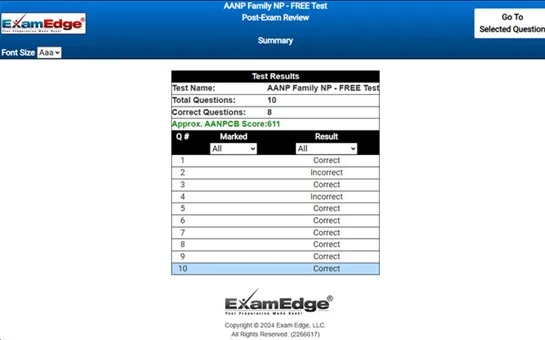

- Create a study schedule: Set aside dedicated study time each week to ensure you're making consistent progress. You might consider having dedicated sessions for each content area, such as a day or week dedicated to different sections of the exam. Plan to take practice tests at regular intervals to chart your progress.

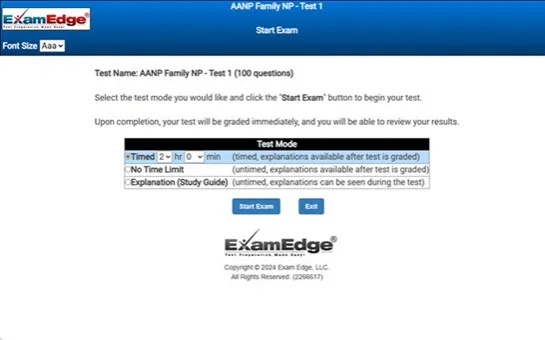

- Take APA Certified Payroll Professional practice tests: Practice exams will give you an idea of the types and format of questions that you can expect on test day. Our practice tests replicate the APA Certified Payroll Professional exam format, with 125 unique question on each practice test. By getting you comfortable with test-taking and getting the most out of your practice tests, our practice tests can help you ace your exam on test day.

General APA Certified Payroll Professional Study Tips

- Find a study partner: Do you have a colleague, classmate, or friend who is also pursuing a APA Certified Payroll Professional certification? Studying with a partner can help keep you accountable and provide an opportunity for discussion and clarification. Practicing test questions together might be an opportunity for some friendly competition too!

- Take breaks: Regular breaks can help prevent burnout and improve retention of information. As you study, give yourself regular pauses to decompress and process what you are learning.

- Stay organized: Keep your notes, study materials, and practice exams organized to avoid feeling overwhelmed. Whether you prefer a physical or digital studying environment (for instance, taking notes by hand versus typing them into your Notes app), a tidy space and methodical approach will help you stay focused on your test prep.

- Take care of your physical health: A healthy body leads to a healthy mind, so make sure your test prep routine also prioritizes exercise, nutrition, and sleep during your study period. During the lead-up to your APA Certified Payroll Professional test day, don't cram - get plenty of rest so your brain is sharp!

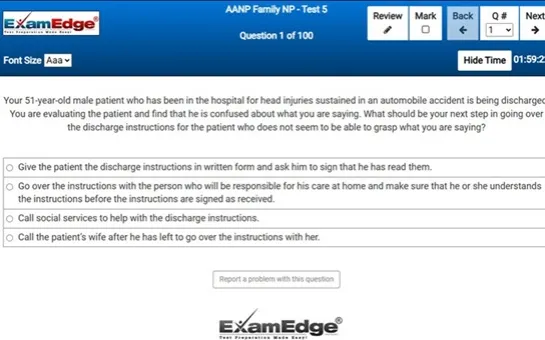

- Utilize test-taking strategies: Techniques, like the process of elimination, can help improve your chances of success. If you are stuck on a difficult practice exam question, try to rule out one or two options to narrow down the possible answer. Exam Edge's test-taking system allows you to flag practice test questions you want to return to - use these features to your advantage!

Want to learn more about effective test prep? Check out our study tips to ace your APA Certified Payroll Professional .

Effective APA Certified Payroll Professional Exam Preparation

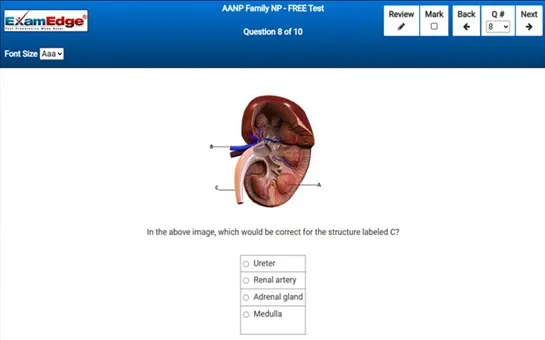

Exam Edge practice tests are tailored to the specific content and format of the real APA Certified Payroll Professional test, to give you a realistic simulation of the exam experience. We provide you with detailed answer explanations for each question, which can help you understand the reasoning behind the correct answer and identify any misconceptions or areas where you need further study. As you gain familiarity with the types of questions and formats you will encounter by taking practice exams, you will feel more prepared and confident going into test day.

Overall, Exam Edge practice tests can be a valuable tool for helping you prepare for your exam. A study plan that incorporates our practice tests can help you to improve your chances of passing the APA Certified Payroll Professional on the first try.

APA Certified Payroll Professional - Study Plan Tips Sample Questions

|

|