AICPA REG Practice Tests & CPA Exam Test Prep - Features

Based on 28 Reviews

- Real Exam Simulation: Timed questions and matching content build comfort for your AICPA REG test day.

- Instant, 24/7 Access: Web-based AICPA Regulation practice exams with no software needed.

- Clear Explanations: Step-by-step answers and explanations for your AICPA exam to strengthen understanding.

- Boosted Confidence: Reduces anxiety and improves test-taking skills to ace your AICPA Regulation (REG).

Features of Exam Edge AICPA Regulation Practice Tests

Accessible AICPA REG Practice Tests

- Instant online practice tests: Because our practice exams are web-based, there is no need to wait for software to download or physical supplies to arrive in the mail. Once you purchase a bundle of practice tests, you can start using them immediately!

- Unlimited test access: Our practice tests never expire. You can revisit each test as much as you would like in order to review the questions and answers.

- Available 24/7: You can pause and resume our practice tests to suit your schedule, at any time of day. Start a practice test in the morning, pause it at noon, and pick it back up at midnight!

- Access your test from any device: Our practice tests are available across multiple devices. As long as you have an internet connection, you can start a practice test on your desktop computer and continue it on your laptop, tablet, or smartphone for on-the-go flexibility.

Access your test from any device

Realistic AICPA Regulation Practice Exam Questions

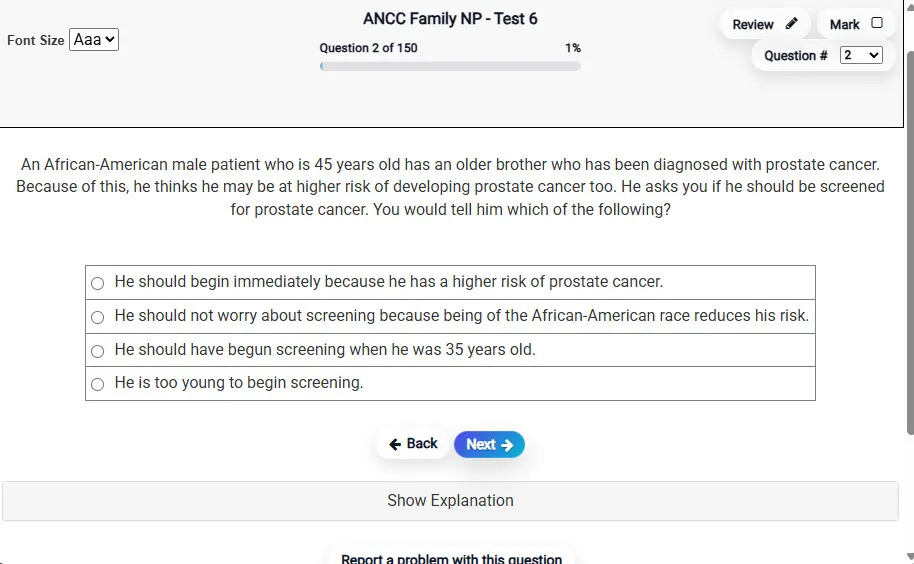

- 100 multiple choice unique questions per exam: Each practice test is unique and matches the length of the real AICPA REG exam so you can practice time management and learn how to maintain focus for the duration of the test.

- 5 online practice exams: Select our largest test bundle for the ultimate AICPA Regulation test prep package - 5 practice tests each test contains 100 unique questions that's 500 unique questions to make you incredibly ready for test day.

Helpful AICPA Regulation Study Guides

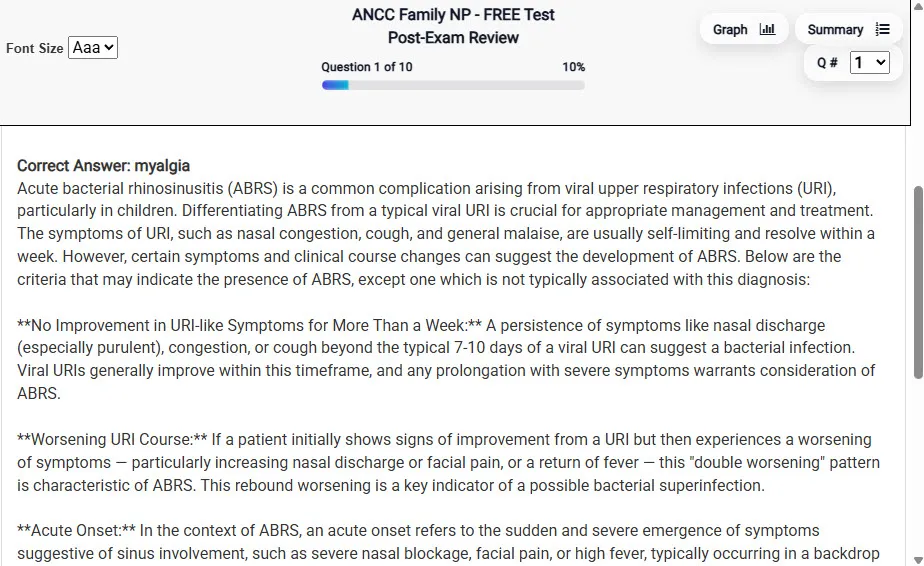

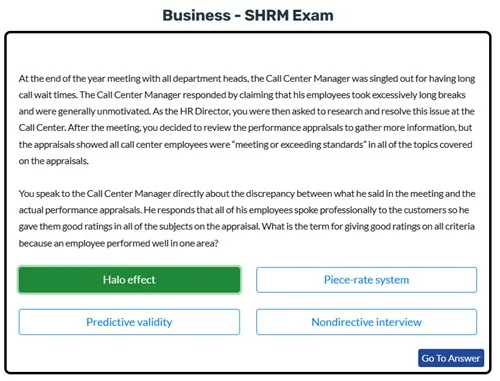

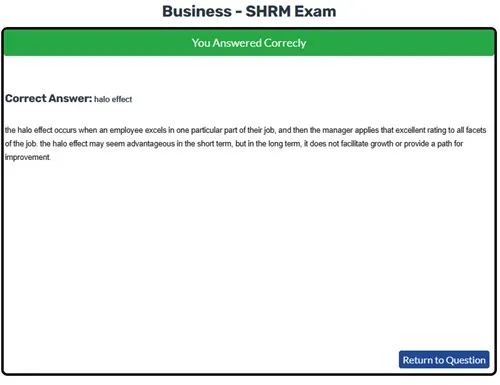

- Detailed explanations for each question: Each AICPA REG practice test question comes with explanations for both correct and incorrect answers to help you understand and learn from your mistakes.

- Repeated attempts on each practice test: You can take each unique practice test up to 4 times to strengthen your recall, hone your pacing, and build your test-taking stamina.

How AICPA Regulation Practice Tests Work

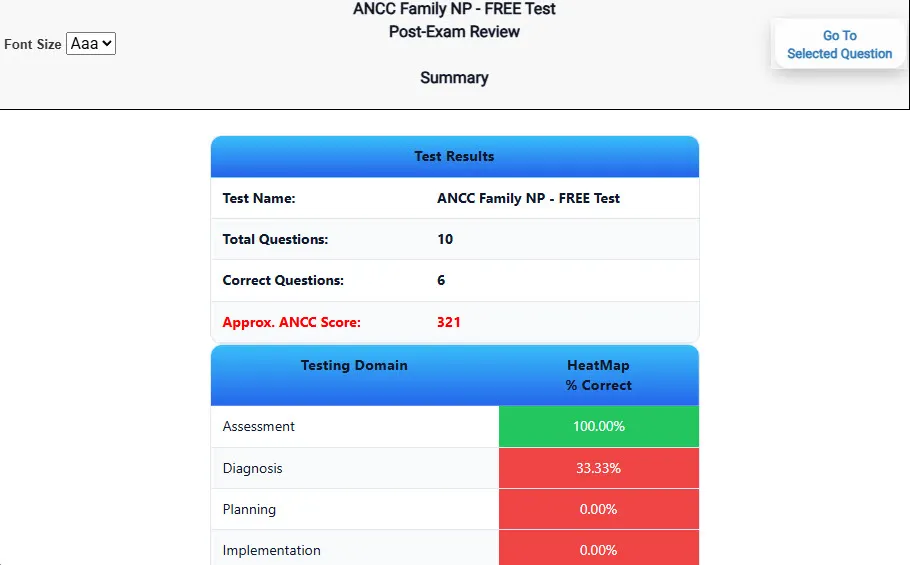

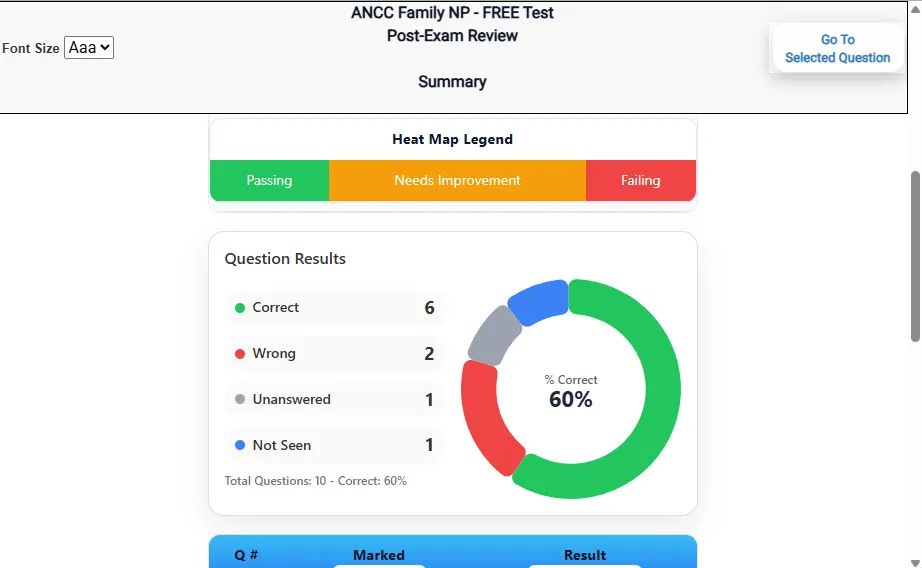

Our unique AICPA REG practice test environment is the closest thing you will find to the actual test, with one exception: we tell you which questions you answered correctly and which you answered incorrectly. And most importantly, we explain why! Our practice test questions give you step-by-step explanations in an easy-to-understand format. This opportunity to understand the practice exam questions and review your answers in depth will bolster your test prep and get you ready for success on test day.

** Sample images, content may not apply to your exam **

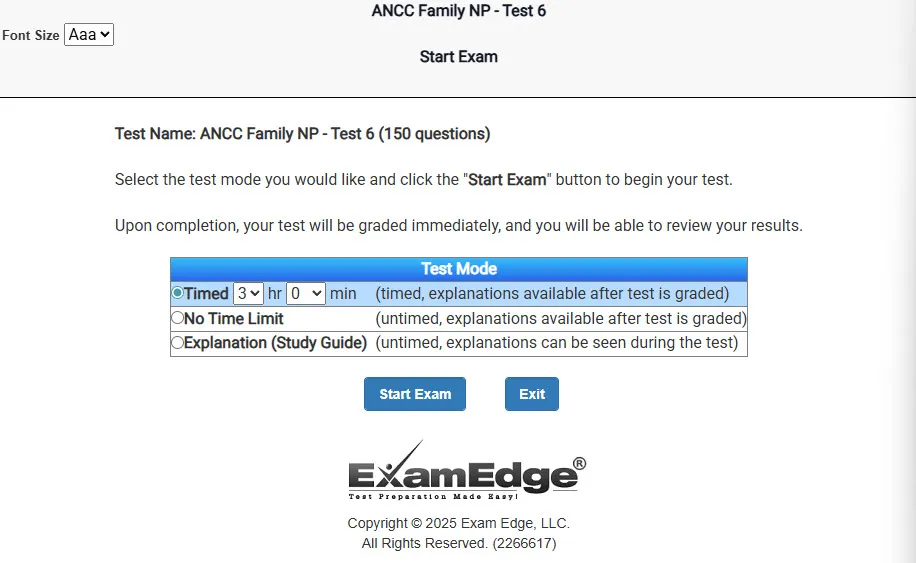

We also know that everyone likes to study differently, so we offer three different ways to use your AICPA Regulation practice exams:

-

Timed AICPA REG Practice Test Mode: Timed tests are just like the AICPA REG exam. Our system sets the test time to the same time limit, or time limit per question, that you will experience with the actual exam on test day. This is a great method of practicing your pacing, especially if you're concerned about completing your exam within the time limit.

-

Untimed AICPA Regulation Practice Test Mode: With this option, you can take your time and thoroughly consider each question before answering. This rush-free mode is recommended for those dipping their toes into exam prep or just starting on their journey to take the AICPA REG. It is a great way to test your knowledge with no time limit and highlight blind spots you will need to come back to in your studies - one of the many advantages of taking AICPA REG practice exams with Exam Edge!

- AICPA Regulation Study Guide Mode: Not sure where to even begin with your studying? Try a practice test in explanation mode. The questions act as a study guide, giving you the option to see the answers as you take the test. Study guide mode is an effective way to review the AICPA REG exam subject matter before you take the exam in a timed format. We recommend taking a practice test in explanation mode and taking thorough notes as the best method for beginning your test prep.

Test Prep Beyond AICPA Regulation Practice Exam Questions

Learn how to solve the entire test-taking puzzle with Exam Edge's AICPA Regulation practice tests! Such exams don't just measure what you know -- they are also a test of how well you perform under pressure. The right type of test preparation helps you familiarize yourself not only with the material you are being tested on but also the format of the test, to help you beat test-taking anxiety. That is the kind of valuable experience you will get with our practice tests and exam prep so you can walk into your exam as prepared as possible and feel ready to pass your AICPA REG exam.

Digital Flashcards

Are you looking to boost your AICPA Regulation exam preparation? Add a pack of digital flashcards to your study routine. Flashcards offer a unique way to enhance your understanding of the material in several ways:

- Enhanced Retention: Flashcards reinforce learning from practice tests through active recall and spaced repetition, which improves memory retention.

- Flexibility: You can use them anytime, anywhere, when you have limited time, and when you cannot complete a practice test.

- Immediate Feedback: Instant feedback on flashcards helps quickly identify and focus on improvement areas.

Using digital flashcards with practice tests offers you the best chance at passing your AICPA REG exam by improving your understanding and retention.

AICPA Regulation Study Guide

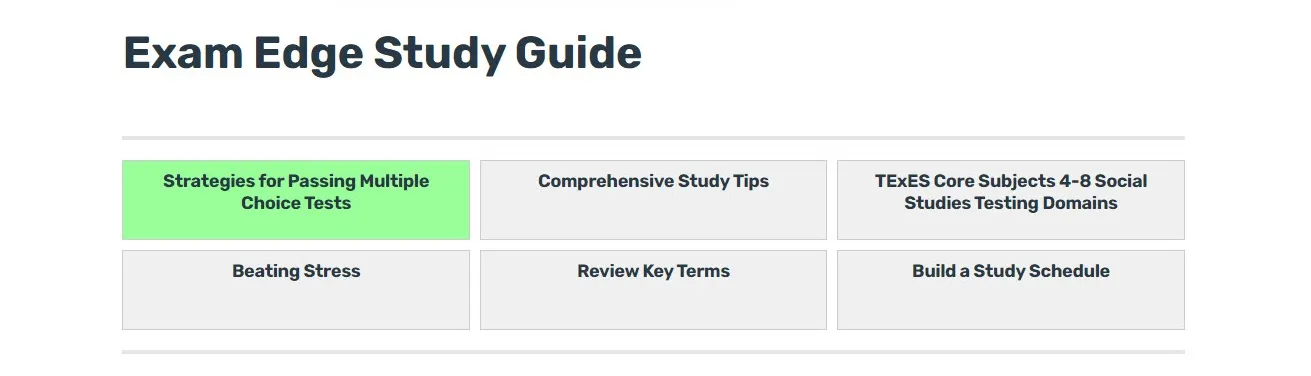

AICPA Regulation Study Guides are available to anyone purchasing a test bundle of 10 or more practice tests.

Here is a summary of the information included in the AICPA REG Study Guides:

- Strategies for Passing Multiple Choice Tests: Understanding the exam format and structure is essential to taking an exam. You can follow these tips to better approach a multiple-choice exam.

- Comprehensive Study Tips: Preparing for your certification exam can be daunting. These study tips provide you with a road map to making your study time as efficient as possible.

- Exam Domains: Having an early grasp on what is on the AICPA REG certification exam is critical. It helps you plan what you need to study to be sure you are ready for your exam.

- Beating Stress: Dealing with exam stress can be very difficult and severely affect your exam performance. Here are some strategies to help you combat that stress.

- Review Key Terms: Reviewing key terms and concepts that will be vital to passing your exam.

- Build a Study Schedule: Managing how to study for the exam can be as stressful as taking the actual exam. Follow the study schedule to maximize your preparation.

We continuously strive to provide resources that empower you to achieve your academic goals. Our Practice Tests, Digital Flash Cards, and Study Guides have been expertly crafted to support a wide range of subjects, and are tailored to foster a deeper understanding and retention of key concepts required to pass your AICPA Regulation certification exam. Using all three of these will ensure you master the skills you need to pass your certification exam.