AICPA AUD (AUD) Practice Tests & Test Prep by Exam Edge - Exam Info

** Sample images, content may not apply to your exam **

The more you know about the AICPA AUD exam the better prepared you will be! Our practice tests are designed to help you master both the subject matter and the art of test-taking to be sure you are fully prepared for your exam.

Here are a few things to think about:

- What is the AICPA AUD certification exam?

- Who is Responsible for the AICPA exam?

- Am I eligibility for the AICPA AUD Exam?

- What is the best way to ensure your succes on the first try?

- The benefits of using Exam Edge to pass your AICPA AUD exam.

Not ready to purchase our complete practice tests yet? Start with a AICPA Auditing and Attestation FREE Practice Test first!

AICPA Auditing and Attestation - Additional Information

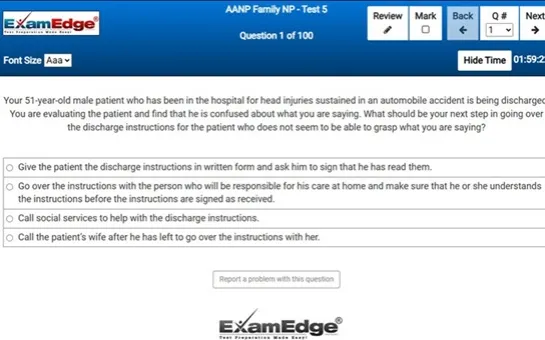

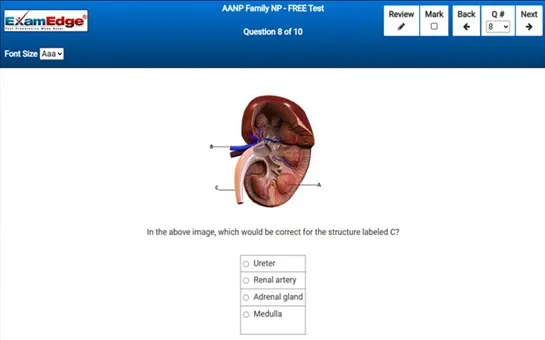

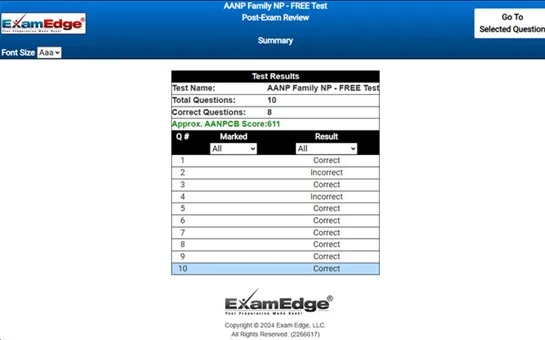

At ExamEdge.com, we focus on making our clients' career dreams come true by offering world-class practice tests designed to cover the same topics and content areas tested on the actual American Institute of Certified Public Accountants AICPA Auditing and Attestation (AUD) Certification Exam. Our comprehensive AICPA Auditing and Attestation practice tests are designed to mimic the actual exam. You will gain an understanding of the types of questions and information you will encounter when you take your American Institute of Certified Public Accountants AICPA Auditing and Attestation Certification Exam. Our AICPA Auditing and Attestation Practice Tests allow you to review your answers and identify areas of improvement so you will be fully prepared for the upcoming exam and walk out of the test feeling confident in your results.

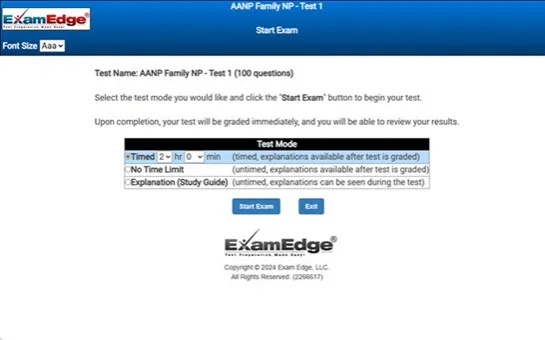

Because our practice tests are web-based, there is no software to install and no need to wait for a shipment to arrive to start studying. Your AICPA Auditing and Attestation practice tests are available to you anytime from anywhere on any device, allowing you to study when it works best for you. There are 5 practice tests available, each with 100 questions and detailed explanations to help you study. Every exam is designed to cover all of the aspects of the AICPA AUD exam, ensuring you have the knowledge you need to be successful!

AICPA Auditing and Attestation - Additional Info Sample Questions

|

|